As vehicle theft and damage continue to be major concerns for car owners, many are exploring ways to protect their cars while saving on car insurance premiums. One increasingly popular option is the installation of driveway bollards. These physical barriers are designed to protect your car from theft, vandalism, and accidental damage, making your driveway more secure.

But the real question is, do driveway bollards reduce car insurance? The answer is yes—installing bollards can potentially lower your insurance costs by reducing the risk of damage or theft. In this article, we’ll explore how bollard installation can help protect your vehicle and lead to insurance premium reductions.

Introduction to Driveway Bollards and Car Insurance

Driveway bollards are physical barriers that act as a deterrent against unwanted access to your property. Often used in both residential and commercial spaces, these security measures can be a game-changer in preventing vehicle theft. Bollards come in various shapes, sizes, and materials, from heavy-duty bollards made of steel to telescopic bollards that can retract into the ground when not in use.

The connection between bollard installation and car insurance premiums lies in how insurers evaluate risk. When you install driveway security measures, your insurance company sees this as a proactive approach to car theft prevention. The more secure your vehicle is, the less likely it is to be involved in a claim. This leads to a reduction in your insurance premiums, potentially saving you a significant amount of money over time.

Why Do Driveway Bollards Reduce Car Insurance?

The main reason driveway bollards can lower your car insurance premiums is because they directly reduce the risk of theft, vandalism, and accidental damage. Bollards create a physical barrier that makes it much harder for thieves or vandals to access your vehicle. This lowers the chances of making an insurance claim, which is a big factor in determining your insurance rates.

In addition to reducing the risk of theft, bollards also protect your car from other threats. For instance, a steel security post placed at the edge of your driveway can stop vehicles from accidentally crashing into your car. This added layer of protection reduces the risk of vehicle-related crime, which can lead to insurance premium reduction over time. Insurance companies see these barriers as evidence that you are taking active steps to protect your vehicle.

Check Out: Our Blog does reinsurance increase the financial risk to the insurer.

Are Car Thefts on the Rise?

Yes, car theft is on the rise in many parts of the country, and it continues to be a serious concern for vehicle owners. In fact, vehicle-related crimes have increased by more than 10% over the past five years, leading to significant losses. In 2023 alone, over 700,000 cars were stolen across the U.S. This troubling trend makes car theft prevention a critical priority for many people.

Because of this growing risk, insurance companies are becoming more selective about who they cover and how much they charge. Driveway bollards are an effective solution to this issue, as they provide a strong physical barrier that can deter thieves and reduce the likelihood of a claim. This is why insurers are more likely to offer insurance discounts to customers who have taken steps like installing anti-ram bollards or other security posts.

How to Reduce Car Insurance with Driveway Bollards

The best way to reduce your car insurance using bollards is by choosing the right type and ensuring proper bollard installation. Not all bollards are equal, and some provide more security than others. Insurance-approved bollards, for instance, meet the standards set by insurance companies to qualify for insurance premium reduction.

To make the most of this strategy, you should work with a professional for bollard installation. A professional bollard installer will ensure the bollards are placed in the most effective spots to protect your vehicle. Once the bollards are in place, be sure to contact your insurance provider and inform them of the new security feature. You might even want to ask if they offer insurance policy discounts for additional security measures.

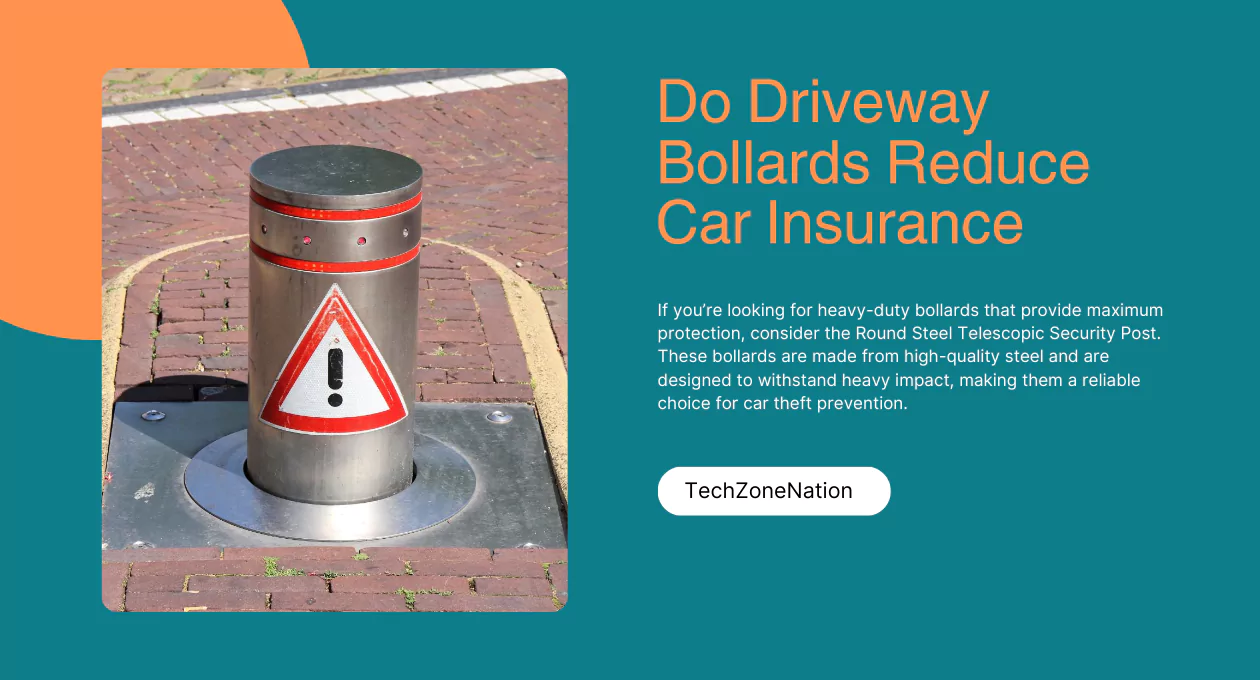

Heavy Duty Round Steel Telescopic Security Post

If you’re looking for heavy-duty bollards that provide maximum protection, consider the Round Steel Telescopic Security Post. These bollards are made from high-quality steel and are designed to withstand heavy impact, making them a reliable choice for car theft prevention. The telescopic bollard design means that it can be retracted into the ground when not in use, giving you flexibility while still offering robust protection when extended.

This type of bollard is often seen as a premium option for homeowners who want to increase their vehicle security systems. It not only improves driveway security but also helps in reducing car insurance costs by significantly lowering the risk of theft or damage to your vehicle.

Rhino RT/SS5 Stainless Steel Telescopic Bollard

Another excellent choice for those serious about vehicle security is the Rhino RT/SS5 Stainless Steel Telescopic Bollard. These bollards are made from stainless steel, which is resistant to corrosion and rust. Their telescopic design allows for easy bollard installation, and they can be manually or remotely controlled for convenience.

The Rhino RT/SS5 bollard offers the perfect balance of security and convenience, making it a top choice for homeowners seeking insurance-approved bollards. Installing these bollards not only enhances driveway security but also provides peace of mind knowing that you’ve taken a critical step in car theft prevention.

Contact Bison Security Posts

For those interested in bollard installation for car insurance premium reduction, Bison Security Posts offers a wide selection of high-quality steel security posts and anti-ram bollards. Their team of experts can guide you through the process of choosing the best security posts for your needs, ensuring that you get both optimal protection and the best possible insurance policy discounts.

With years of experience in bollard installation, Bison Security Posts provides certified bollards that meet the highest standards of safety and security. Whether you’re looking for automatic bollards or remote-controlled bollards, Bison has a solution for you.

Why Choose Us for Your Security Bollards and Barriers

Choosing the right bollard for your driveway is crucial when it comes to maximizing car insurance discounts. Bison Security Posts offers an extensive range of bollards designed for durability, effectiveness, and ease of use. Their products, including heavy-duty bollards, telescopic bollards, and vehicle security systems, are all tested to ensure they meet the highest standards for insurance-approved bollards.

Bison’s bollards are not only easy to install but also provide long-term protection against car theft and vehicle-related crimes. By working with professionals, you can ensure that your bollards are correctly positioned to provide the maximum car insurance premium reduction.

Check out: Our Blog how much is an ent visit without insurance.

The Impact on Your Premium

The installation of bollards has a significant impact on your car insurance premiums. According to various insurance studies, drivers who implement security measures such as bollards, steel security posts, and other vehicle security systems can expect to see a reduction in their premiums. Insurance companies understand that bollards reduce the chances of theft and damage, and they reward customers who take steps to protect their property.

In fact, car insurance companies often offer premium reductions of up to 10% or more for customers who install insurance-approved bollards. The specific amount of the discount will depend on your insurer and the type of bollard you install. It’s always a good idea to check with your insurer to see how they value these security measures.

What Insurance Companies Want to See

When it comes to bollard installation, insurance companies want to see that the bollards are properly installed and offer a significant level of security. Insurance-approved bollards typically need to meet certain standards, such as being anti-theft, durable, and easy to deploy when needed.

If you’re installing driveway security posts, make sure they are clearly visible and are in the correct location. Ensure that your bollard system is certified for car insurance savings, and keep all relevant documentation to show your insurer that your vehicle is better protected.

Getting Maximum Reductions

To get the maximum reduction in your car insurance premiums, it’s important to choose the right bollards and combine them with other security measures, like alarm systems, motion detectors, and security cameras. The more layers of protection you add, the more likely your insurer is to offer you a discount.

Additionally, be sure to keep your insurance provider updated with any new security measures you install. The more proactive you are in reducing the risk of theft or damage, the greater the chance of getting an insurance premium reduction.

Making It Work For You

Installing bollards is a smart investment for anyone looking to reduce car insurance premiums while enhancing vehicle security. However, the effectiveness of your bollards will depend on how well they are installed and maintained. Work with a professional to ensure that your bollards are positioned correctly, and always keep your insurance provider informed about the security measures in place.

With the right bollards, you can protect your vehicle and potentially save a significant amount on your car insurance premiums.

Ready to Protect Your Driveway?

If you’re ready to protect your vehicle and reduce your insurance premiums, installing driveway bollards is a step in the right direction. Whether you choose steel bollards, telescopic bollards, or automatic bollards, there is a solution to meet your needs. Take action today, and start enjoying the benefits of vehicle security systems and car insurance savings.

Why Insurers Love Bollards

Insurers love bollards because they reduce the likelihood of claims. The physical barriers that bollards provide help prevent car theft, vandalism, and accidents, which ultimately lowers the insurance costs for both the insurer and the policyholder. When you install bollards, you’re showing your insurer that you’re taking responsibility for your vehicle’s safety, and they reward you with insurance policy discounts.

By adding bollards to your driveway, you can not only improve your vehicle’s security but also enjoy long-term savings on your car insurance premiums.

FAQs

Do bollards reduce insurance?

Yes, installing bollards can reduce insurance premiums by lowering the risk of theft and damage to your vehicle.

Do driveway bollards prevent car theft?

Yes, driveway bollards act as a strong physical barrier, making it harder for thieves to access or steal your vehicle.

Does parking in a garage lower car insurance?

Yes, parking in a garage typically lowers car insurance premiums since it provides additional protection against theft and damage.

Do wheel locks reduce insurance?

Yes, wheel locks can help reduce insurance premiums by adding an extra layer of security against theft.

Is it allowed to install a bollard in my parking space?

Yes, you can install a bollard in your parking space to enhance security, but make sure it complies with local regulations.

Conclusion

In conclusion, installing driveway bollards is a highly effective way to enhance your vehicle security systems and lower your car insurance premiums. These physical barriers act as a strong deterrent against car theft, vandalism, and accidents, which are all factors that contribute to high insurance costs. By choosing insurance-approved bollards, whether telescopic bollards or steel security posts, and working with professional bollard installation services, you can significantly reduce the risk to your vehicle.

Additionally, notifying your insurance provider about these security measures could lead to valuable insurance discounts. Ultimately, bollard installation not only protects your car but also saves you money in the long run. If you’re looking to reduce car insurance costs and increase your peace of mind, bollards offer a practical and cost-effective solution.

For more insurance blogs keep visiting ALLUSINSURANCE.